Question 1.

Market value of a share is ₹ 200. If the brokerage rate is 0.3% then find the purchase value of the share.

Solution:

Here, MV = ₹ 200, Brokerage = 0.3%

Brokerage = 0.3% of MV

= × 200

= ₹ 0.6

∴ Purchase value of the share = MV + Brokerage

= 200 + 0.6

= ₹ 200.60

∴ Purchase value of the share is ₹ 200.60.

Question 2.

A share is sold for the market value of ₹ 1000. Brokerage is paid at the rate of 0.1%. What is the amount received after the sale?

Solution:

Here, MV = ₹ 1000, Brokerage = 0.1%

∴ Brokerage = 0.1 % of MV

= × 1000

∴ Brokerage = ₹ 1

∴ Selling value of the share = MV – Brokerage

= 1000 – 1

= ₹ 999

∴ Amount received after the sale is ₹ 999.

Question 3.

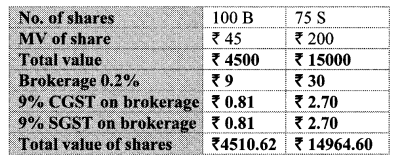

Fill in the blanks given in the contract note of sale-purchase of shares.

(B – buy S – sell)

Solution:

For buying shares:

Here, Number of shares = 100,

MV of one share = ₹ 45

∴ Total value = 100 × 45

= ₹ 4500

Brokerage= 0.2% of total value 0.2

= × 4500

CGST = 9% of brokerage

= × 9 = ₹ 0.81

But, SGST = CGST

∴ SGST = ₹ 0.81

∴ Purchase value of shares

= Total value + Brokerage

= 4500 + 9 + 0.81 + 0.81

= ₹ 4510.62

ii. For selling shares:

Here, Number of shares = 75,

MV of one share = ₹ 200

∴ Total value = 75 × 200

= ₹ 15000

Brokerage = 0.2% of total value

= × 15000

= ₹ 30

CGST = 9% of brokerage

= × 30 = ₹ 2.70

But, SGST = CGST

∴ SGST = ₹ 2.70

∴ Selling value of shares = Total value – (Brokerage + CGST + SGST)

= 15000 – (30 + 2.70 + 2.70)

= 15000 – 35.40

= ₹ 14964.60

Question 4.

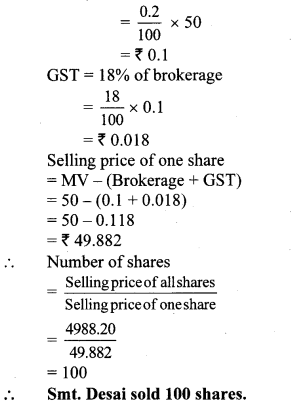

Smt. Desai sold shares of face value ₹ 100 when the market value was ₹ 50 and received ₹ 4988.20. She paid brokerage 0.2% and GST on brokerage 18%, then how many shares did she sell?

Solution:

Here, face value of share = ₹ 100,

MV = ₹ 50,

Selling price of shares = ₹ 4988.20,

Rate of brokerage = 0.2%, Rate of GST = 18%

Brokerage = 0.2% of MV

Question 5.

Mr. D’souza purchased 200 shares of FV ₹ 50 at a premium of ₹ 100. He received 50% dividend on the shares. After receiving the dividend he sold 100 shares at a discount of ₹ 10 and remaining shares were sold at a premium of ₹ 75. For each trade he paid the brokerage of ₹ 20. Find whether Mr. D’souza gained or incurred a loss? By how much?

Solution:

For purchasing shares:

Here, FV = ₹ 50, Number of shares = 200,

premium = ₹ 100

MV of 1 share = FV + premium

= 50 + 100

= ₹ 150

∴ MV of 200 shares = 200 × 150 = ₹ 30,000

∴ Mr. D’souza invested amount

= MV of 200 shares + brokerage

= 30,000 + 20

= ₹ 30,020

For selling shares:

Rate of dividend = 50 %, FV = ₹ 50,

brokerage = ₹ 20

Number of shares = 200

Dividend per share = 50% of FV

= × 50

= ₹ 25

∴ Dividend of 200 shares = 200 × 25 = ₹ 5,000

Now, 100 shares are sold at a discount of ₹ 10.

∴ Selling price of 1 share = FV – discount

= 50 – 10

= ₹ 40

∴ Selling price of 100 shares = 100 × 40

= ₹ 4000

∴ Amount obtained by selling 100 shares

= selling price – brokerage

= 4000 – 20

= ₹ 3980

Also, remaining 100 shares are sold at premium of ₹ 75.

∴ selling price of 1 share = FV + premium

= 50 + 75

= ₹ 125

∴ selling price of 100 shares = 100 × 125

= ₹ 12,500

∴ Amount obtained by selling 100 shares

= selling price – brokerage

= 12,500 – 20

= ₹ 12,480

∴ Mr D’souza income = 5000 + 3980 + 12480

= ₹ 21460

Now, Mr D’souza invested amount > income

∴ Mr D’souza incurred a loss.

∴ Loss = amount invested – income

= 30020 – 21460

= ₹ 8560

∴ Mr. D’souza incurred a loss of ₹ 8560.

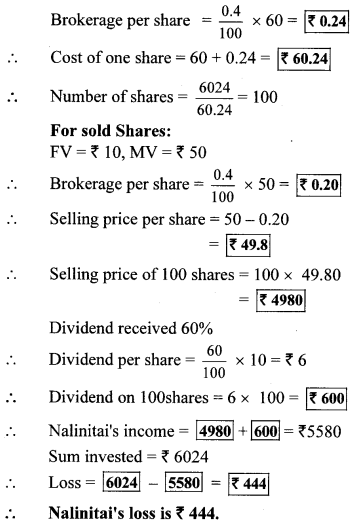

Question 1.

Nalinitai invested ₹ 6024 in the shares of FV ₹ 10 when the Market Value was ₹ 60. She sold all the shares at MV of ₹ 50 after taking 60% dividend. She paid 0.4% brokerage at each stage of transactions. What was the total gain or loss in this transaction? (Textbook pg. no. 106)

Solution:

Rate of GST is not given in the example, so it is not considered.

For Purchased Shares:

FV = ₹ 10, MV = ₹ 60

Question 2.

In the above example if GST was paid at 18% on brokerage, then the loss is ₹ 451.92. Verify whether you get the same answer. (Textbook pg, no. 107)

Solution:

For Purchased Shares:

FV = ₹ 10, MV = ₹ 60, sum invested = ₹ 6024, brokerage = 0.4 %, GST = 18%

Brokerage per share = × 60 = ₹ 0.24 100

GST per share = × 0.24 = ₹ 0.0432

∴ Cost of one share = 60 + 0.24 + 0.0432

= ₹ 60.2832

∴ Cost of 100 shares = 100 × 60.2832 = ₹ 6028.32

For sold shares:

FV = ₹ 10, MV = ₹ 50, brokerage = 0.4 %,

GST = 18%, Number of shares = 100

Brokerage per share = × 50 = ₹ 0.20

GST per share = × 0.20 = ₹ 0.036

Selling price per share = 50 – 0.2 – 0.036

= ₹ 49.764

Selling price of 100 shares = 100 × 49.764

= ₹ 4976.4

Dividend received 60 %

∴ Dividend per share = × 10 = ₹ 6

Dividend on 100 shares = 6 × 100 = ₹ 600

∴ Nalinitai’s income = 4976.4 + 600 = ₹ 5576.4

∴ Cost of 100 shares = ₹ 6028.32

∴ Loss = 6028.32 – 5576.4 = ₹ 451.92

∴ Nalinitai’s loss is ₹ 451.92.